Crypto wallets and crypto exchanges have some areas in which they overlap, but they are not the same. Crypto wallets are pieces of hardware or software that serve as a conduit between your holdings and the blockchain, enabling users to send, receive or store crypto. Exchanges, on the other hand, are online marketplaces where users can buy, sell and trade crypto. Many exchanges provide wallet services to account holders, but for security reasons more seasoned crypto users usually prefer to keep their funds inside a wallet to retain control of private keys (aka self-custody), versus having exchanges hold the assets in custody.

In this article

- What is a crypto wallet?

- What is a crypto exchange?

- Deciding which is right for you

- Which is safer?

- Moving funds from an exchange to a self-custody wallet

Wallets and exchanges are two cornerstone components of cryptocurrency — with the majority of crypto activity involving one or the other (and sometimes both). If you’ve ever bought, sold, traded, swapped, spent, sent or received cryptocurrency, the transaction was executed using a wallet or exchange whether you knew it or not. Although at times intertwined, wallets and exchanges are not the same thing.

Whether a wallet, an exchange or a hybrid solution is the best choice for you depends on your needs and your level of comfort with crypto. Ahead, we’ll explore the differences and similarities between crypto wallets and exchanges and talk about which solution may be right for your crypto strategy.

What is a crypto wallet?

The term “crypto wallet” seems to give many people the false impression that it physically stores or contains their holdings in some way. A crypto wallet is actually just a small device or piece of software that allows the owner to manage their funds on the blockchain. When a new wallet is created, it generates a pair of “keys”, lengthy alphanumeric sequences used in tandem to send and receive crypto to or from the wallet address. The public key is safe to share with anybody who wants to send you some cryptocurrency, much like you would a checking account number. The private key, however, must be carefully safeguarded, as anybody who gets their hands on it will be able to take control of your holdings. What a wallet actually “stores” is your private key, without which no crypto transactions would be possible.

How much (if at all) you interact with your crypto wallet depends on the kind you use. There are different types of crypto wallets out there with varying combinations of attributes. Some, like the BitPay Wallet, come with added benefits of a free crypto debit card, opportunity to turn crypto into gift cards, plus other ways to spend crypto.

The most popular types of wallets include:

- Desktop wallets - They’re usually lightweight, easy-to-use applications that are excellent for securely conducting small, everyday crypto transactions right from your computer. Read more about desktop wallets.

- Mobile wallets - Mobile crypto wallets let users securely spend or receive funds from their phone anywhere there’s an internet connection. Learn about choosing the best mobile wallet for you.

- Web wallets - Web wallets are one of the main convergence points between wallets and exchanges. When you open an account with a crypto exchange, they create a wallet for you which lets you manage your funds directly from your web browser. As we’ll get into below, these wallets will most likely be “custodial” wallets.

- Paper wallets (cold) - As the name suggests, paper wallets are a method of secure crypto storage where private keys are written or typed on a piece of paper and locked away safely.Hardware wallets (cold) - Hardware wallets are small devices about the size of a thumb drive which securely store a user’s private keys. These devices are offline most of the time, and made to plug into a computer via USB when executing a crypto transaction. Learn more about hardware wallets and how to use them.

What is a crypto exchange?

Functionally, crypto exchanges are a bit more straightforward than wallets, serving primarily as marketplaces where crypto prices are listed and a variety of coins can be bought and sold. Many of them offer custodial web wallet services as outlined above, but their main purpose is providing a platform to buy and sell cryptocurrency. Crypto exchanges can be placed in two distinct categories:

- Centralized Exchanges (CEXes) - Crypto exchanges that are governed by a single entity which is responsible for making a market for buyers and sellers and maintaining its order books. Typically present a diverse range of available coins, easy to navigate sites, and custodial wallet services for those who don’t wish to self-custody. Popular centralized exchanges include Coinbase, Kraken and Binance.

- Decentralized Exchanges (DEXes) - An exchange which offers direct peer-to-peer crypto transactions without an intermediary. The biggest difference between centralized and decentralized exchange is the ability to buy/sell crypto without giving up control of your private keys. Popular decentralized exchanges include Uniswap, Sushiswap and Paxful.

Which is right for me?

The answer to this question is subjective, and entirely depends on factors like your level of comfort with technology, your crypto usage style or your security concerns. Remember, there are also subcategories and types for each, so you can craft different combinations of features and functions to suit your needs. As a general guideline, we’ve created a few scenarios to help steer you in the right direction.

I am new to cryptocurrency and want to buy a little, dabble in trades/swaps and make the occasional payment.

Solution: Create an account with a trusted centralized exchange wallet and reassess in a few months once you’re comfortable with how crypto works and how you’d like to use it.

I have been in crypto for 6+ months and want to explore the benefits of self-custody.

Solution: Create a self-custody wallet (like the BitPay Wallet) and begin branching off onto decentralized exchanges when necessary. Begin to move any assets held on a custody solution to a self-custody solution.

I currently live on crypto or plan to live on crypto – crypto is or will be a major aspect of my financial plan.

Solution: Use a combination of self-custody mobile wallet for seamless payments and transactions, hardware wallet for long term savings and a decentralized exchange if you ever need to to make a P2P buy/sale. Explore multisig wallets and other advanced wallet options to improve security of your assets.

Which is safer?

Any means of crypto storage will have its risks. On one hand, crypto institutions can be hacked (Mt. Gox) or face legal troubles (FTX), resulting in your funds being manipulated by a third party. On the other hand, the biggest risk to funds kept in a self-custody wallet is likely yourself. Being your own banker comes with responsibility, including safeguarding your recovery phrase and not falling prey to common crypto scams. Consider the following questions to decide which presents a greater risk to your assets:

- Do I trust a centralized intermediary to safeguard my funds?

- Am I ready to take the proper crypto safety precautions to securely self-custody my funds?

Can I move my assets from a centralized exchange to a self-custody wallet?

Absolutely, moving assets from a centralized exchange to a self-custody solution wallet like BitPay is easy. We walk you through it step by step in our guide to self-custody wallets. The process is as followed:

Step 1: Create a self-custody wallet

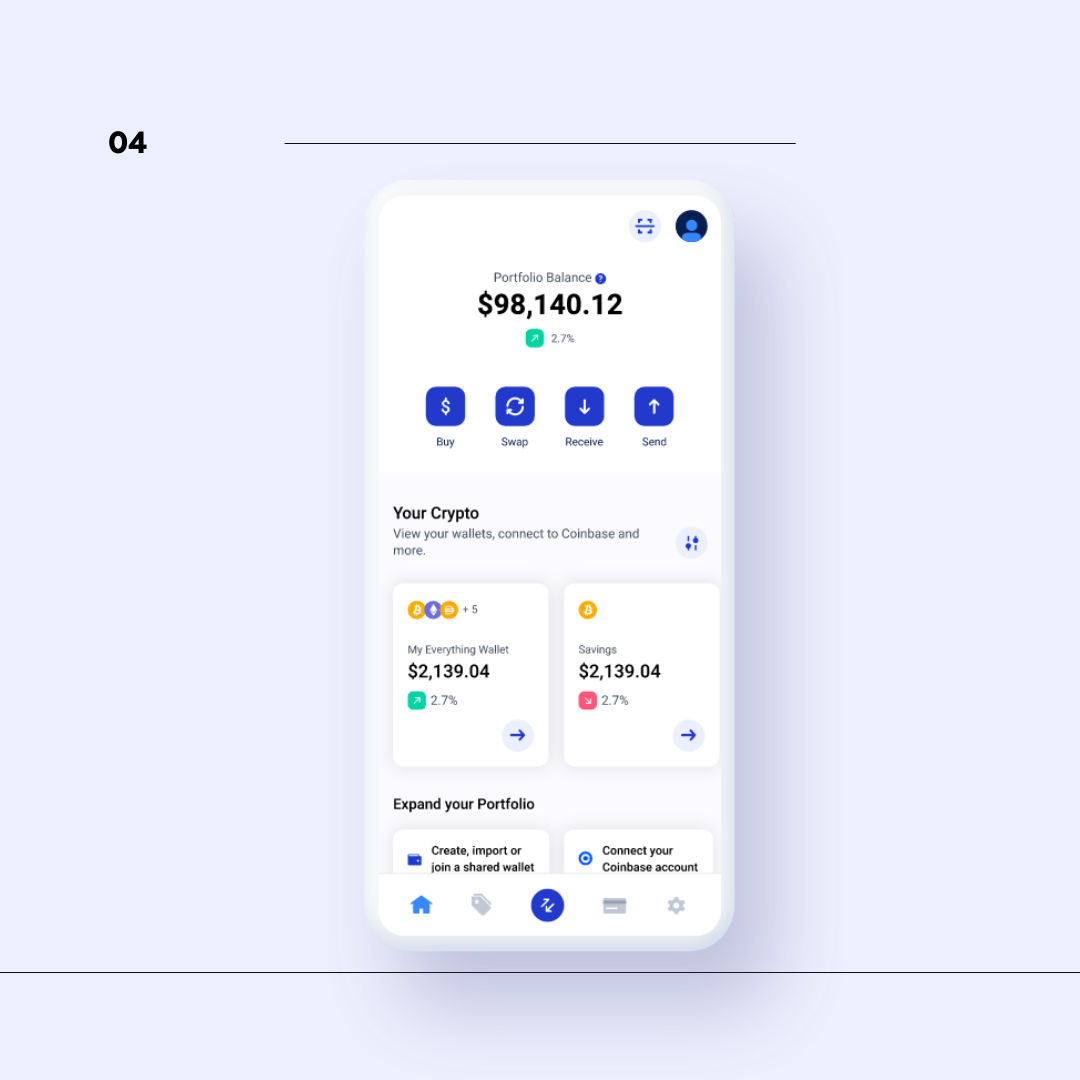

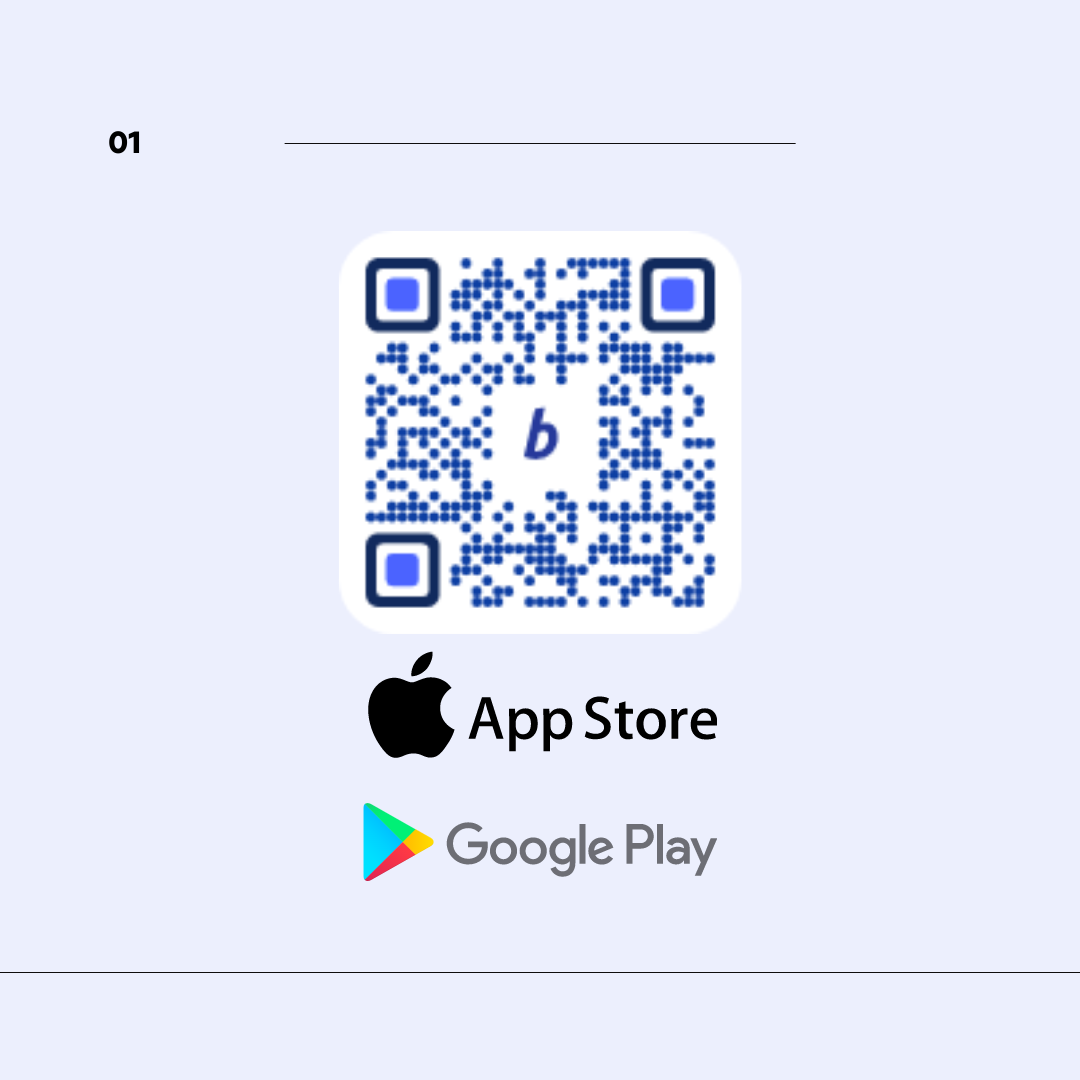

Download BitPay Wallet for free. It's available on mobile, tablet and desktop devices across Android, iOS, Mac, Windows and Linux operating systems. Once you have the app, create a key along with a wallet for each cryptocurrency you wish to store.

Step 2: Record your new wallet address (or addresses)

You’ll need to know your wallet’s address. In the BitPay Wallet app, you can find this by selecting “My Key” on the home screen, tapping into your wallet, tapping the three dots in the upper right corner, and finally selecting “Share Address”. From here you can write down your wallet address or copy it to your clipboard for the next steps.

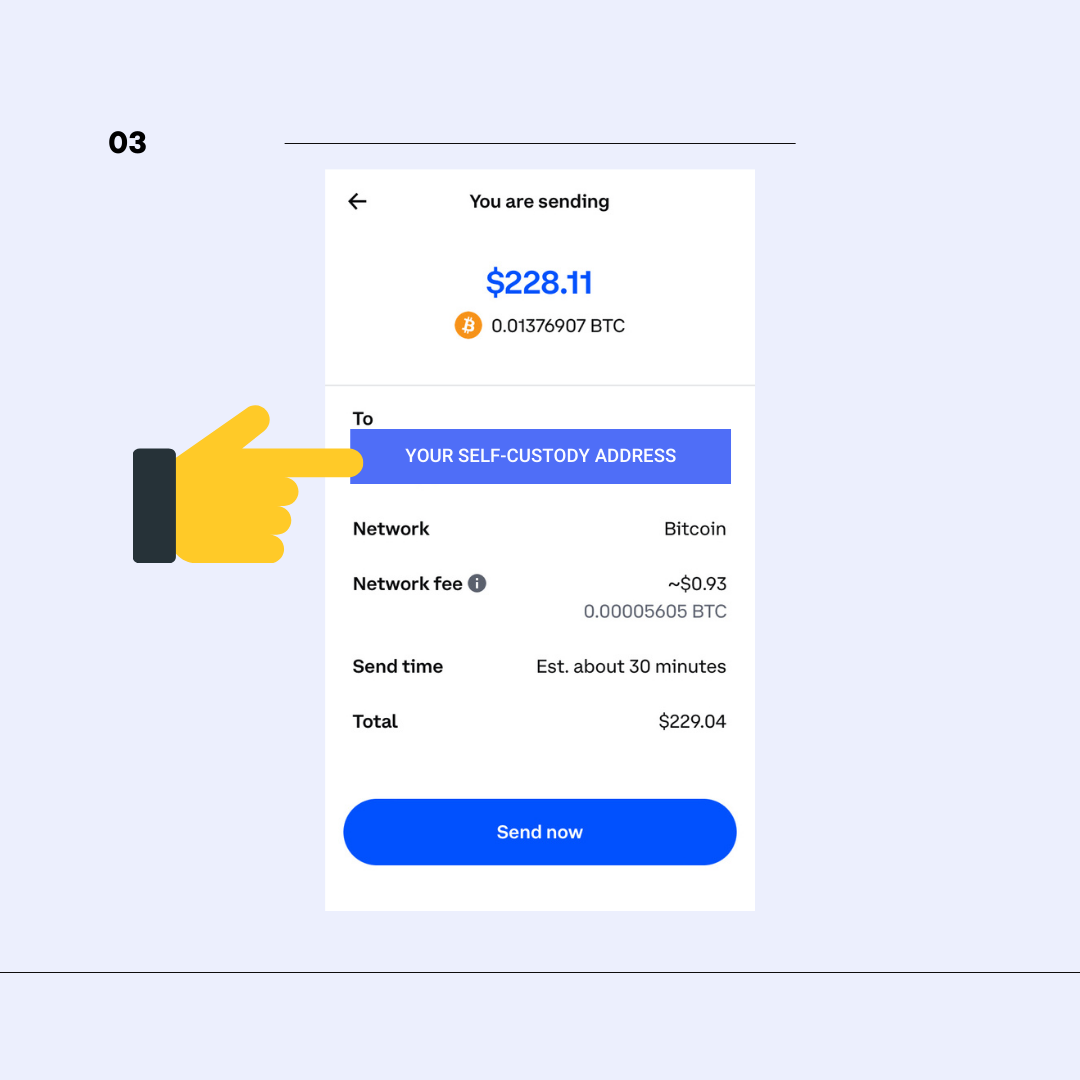

Step 3: Initiate the transfer from your custodial account

In most cases, transferring assets from a custodial service like Coinbase to a self-custody wallet like BitPay is as simple as sending crypto from one address to another. With your new self-custody wallet addresses on hand, log into your custodial account. Select the Send option in your custodial account. Select the asset you’d like to transfer. Enter in your new self-custody address (the one we just created a few steps ago). Now enter the amount of cryptocurrency you’d like to transfer. Review the transaction details and confirm to send the payment.

These steps may vary depending on your custodial service. Review the steps for popular custodial services below.

- Transfer instructions for Coinbase custody wallets

- Transfer instructions for Kraken custody wallets

- Transfer instructions for Gemini custody wallets

Step 4: Enjoy the new control of a self-custody wallet

Once the transaction is complete, you’ll see your transferred crypto in the “My Key” section of the BitPay app. While self-custody means that there is no third party in between you and your crypto, you should still exercise extreme caution to keep your crypto safe, especially with regards to your wallet’s recovery phrase. In order to protect your funds from being accessible to hackers and thieves, store your recovery phrase in a safe and secure place.