Tax season is here. Fortunately, BitPay users can be ready. We have created helpful tools for users who need records for tax filing, accounting, and other reporting purposes.

Since the IRS considers bitcoin transactions to be sales of property, gains and losses in the value of bitcoin you spend are subject to capital gains taxes. In this blog post, we'll give a quick overview of everything BitPay users need to know about how to use our reporting tools to get information on gains and losses.

Remember that you should always consult a tax professional regarding any tax filing needs. This blog post is an overview of BitPay's tools to make reporting easy – not tax guidance.

BitPay Merchant Transactions

If you are using BitPay to accept Bitcoin and Bitcoin Cash payments at your business, we have your back. If your business processes over $20,000 in payments per year with BitPay, we already provide you with the required 1099K forms.

Many BitPay merchants receive all of their settlement for incoming payments in the form of Euros, US dollars, or another one of BitPay's supported local currency settlement options. They never touch Bitcoin or make the Bitcoin transactions considered taxable by the IRS. However, if you are receiving Bitcoin settlement and want to keep track of the exchange rate at which you received your funds, you can download a ledger of your settlements in your BitPay merchant dashboard.

BitPay and Copay Wallets

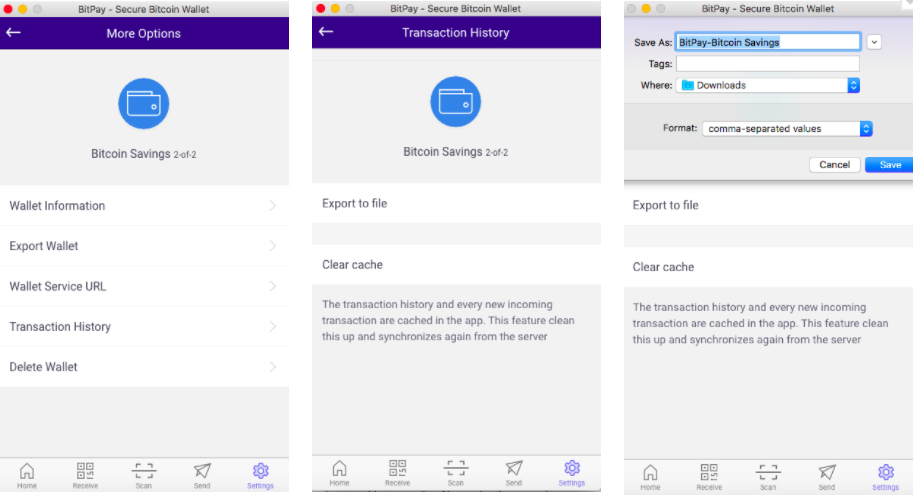

If you are using the BitPay or Copay wallet to make your Bitcoin or Bitcoin Cash transactions, the BitPay and Copay wallet desktop versions have a straightforward CSV export feature that is easy to access:

- Open your wallet and select Settings.

- Select your wallet under Bitcoin Wallets or Bitcoin Cash Wallets.

- Select More Options and then Transaction History.

- Select Export to file to export a CSV file.

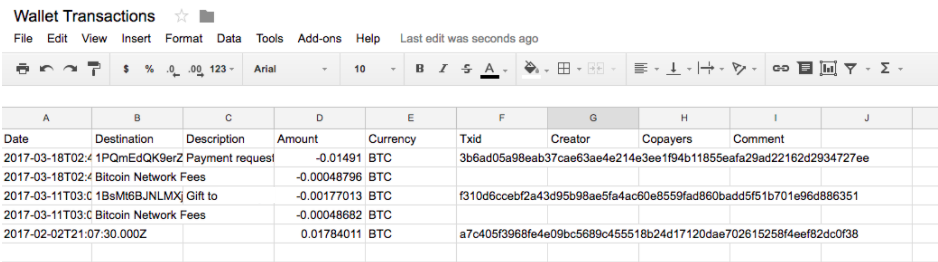

You can then upload the CSV export file for these transactions into Google Sheets or Excel. These programs will give you a way to view, sort, and make calculations about your transaction history over time.

Finally, to get an idea of your gains and losses on each transaction, you can provide your BitPay wallet bitcoin addresses you used in the last year to a service like Libra. Libra's service LibraTax calculates the gains and losses from each transaction and also provides a CSV record.

Once you have that record, take your BitPay wallet CSV export and filter out which transactions were taxable purchases or sales by looking at your Description column. Now you have everything you need to report for tax purposes.

BitPay Card

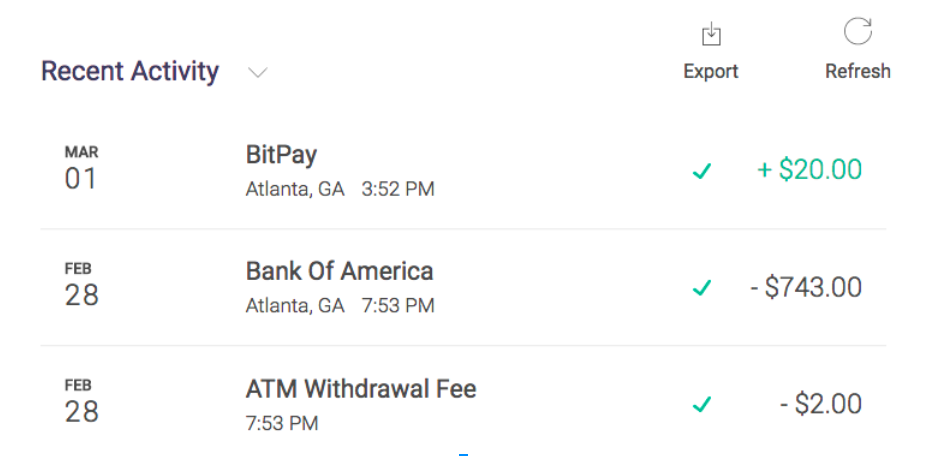

Once you load the BitPay Card, it only holds a US dollar balance, and all purchases with the BitPay Card are denominated in US dollars. When you pay merchants or withdraw from ATMs using the BitPay Card, you are not transacting in Bitcoin or Bitcoin Cash. That means you don't have to do any extra for tax reporting for your everyday usage of the BitPay Card.

But when you load the BitPay Card with dollars using Bitcoin or Bitcoin Cash, you are making a transaction which the IRS considers to be taxable under its digital currency tax guidance.

To export a CSV list of your load transactions, just log into your BitPay Card account, select your preferred date range, and click Export. In no time you'll have a nice, neat record of the Bitcoin or Bitcoin Cash you turned into dollars on the BitPay Card.

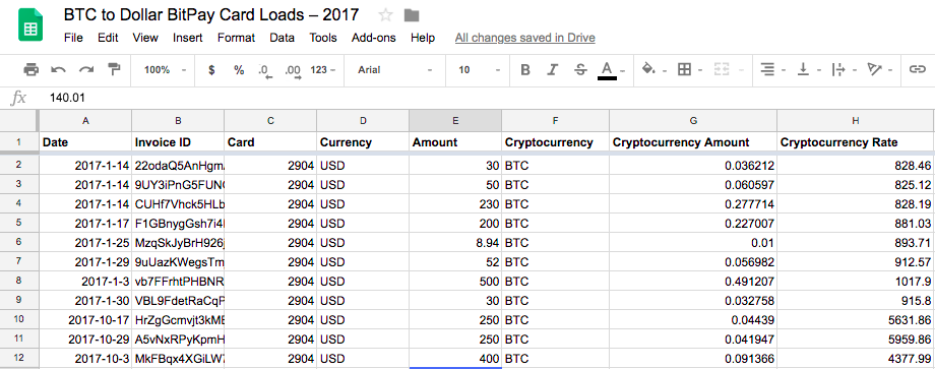

Once you have your CSV, you can upload it to Microsoft Excel, Google Sheets, or any other spreadsheet software to view your transaction history:

Remember: this export only includes your BTC-to-dollar or BCH-to-dollar load transactions because only these transactions are considered taxable sales of property by the IRS.

Have more questions? Check out our blog in response to the IRS ruling on digital currencies.**

The BitPay Visa® Prepaid Card is issued by Metropolitan Commercial Bank, member FDIC, pursuant to a license from Visa, U.S.A. Inc. “Metropolitan” and “Metropolitan Commercial Bank” are registered trademarks of Metropolitan Commercial Bank © 2014. Use of the Card is subject to the terms and conditions of the applicable Cardholder Agreement and fee schedule, if any.