Many factors go into choosing the right crypto wallet for your lifestyle and crypto needs. But one of the biggest to consider is how much you value convenience versus security. After all, that’s the real choice you’re making when choosing between the different types of crypto wallets. Mobile crypto wallets attempt to split the difference, giving users greater flexibility to manage their funds while also providing enhanced security features. Ahead we’ll take a closer look at mobile wallets, and why they’re a popular choice for the crypto users.

What are mobile crypto wallets?

Mobile crypto wallets are software programs that secure users’ funds and allow them to interact with their crypto holdings using their phone or any other internet-connected mobile device. Remember: no matter what kind of wallet you use, your crypto isn’t actually stored inside it. Your funds “live” on the blockchain, and a wallet is merely the conduit through which you can access them.

Mobile wallets are of the “hot” variety, meaning they require an active internet connection, as opposed to offline or “cold” wallet types such as hardware wallets. Some other examples of hot wallets include desktop wallets and web wallets, with desktop wallets being the closest analog to mobile wallets. In fact, many mobile wallet providers offer a desktop variant as well.

The biggest benefit of a mobile wallet is the convenience of taking your crypto spending power with you anywhere you go. The apps are generally user-friendly, and make it easy to buy, store, swap, spend or otherwise manage your crypto from your mobile device. Keep in mind that best crypto safety practices say you should never keep large amounts of crypto in any hot wallet. That means for optimal security when using a mobile crypto wallet, it’s best to either self-custody your assets (more on that in a minute) or use it in tandem with a secure offline storage method like a hardware wallet.

What types of mobile wallets are there?

The primary difference between types of mobile wallets comes down to custodial vs. non-custodial.

With custodial wallets, your private keys are held by whichever company provides the wallet. Private keys are like the ATM PIN code to your crypto funds, and whoever holds them has total access to their corresponding wallet. Custodial wallets are best for crypto users who prefer to keep things simple, and don’t mind the idea of an exchange or wallet service possessing their keys. Many crypto users, however, are uncomfortable with the idea of a third-party controlling their private keys. Enough that the phrase “not your keys, not your crypto” has become a common refrain among proponents of the other type of wallet, non-custodial wallets. Some well-known custodial wallet providers include Crypto.com, Coinbase and Kraken.

Non-custodial wallets, also known as self-custody wallets, give the holder absolute control over their private keys, and by extension their crypto funds. More experienced or security-conscious crypto users generally prefer self-custody wallets because the responsibility of securing their funds falls on them, not a third party. Non-custodial wallet users effectively become their own banker, which is seen as a plus by some and a drawback by others. Custodial wallet holders also become the sole guardian of their secret recovery phrase. The secret phrase is the only means of recovering funds from a broken or stolen device, so it is paramount that this is kept safe! Non-custodial crypto wallets come in web, software or hardware form. Some well-known providers, in addition to BitPay Wallet, include Trust Wallet, Electrum, Exodus, Edge Wallet, Blockchain.com and MetaMask.

Benefits of mobile wallets

Mobile wallets offer a nice blend of utility and security. When used in combination with some form of offline (“cold”) crypto storage, you get the flexibility of a mobile wallet with the protection of a cold wallet. Users like mobile wallets for many reasons, including:

- Safety: mobile crypto wallets are as secure as any other “hot” wallet

- Portability: carry your crypto spending power right in your pocket, anywhere you go

- Flexibility: handle most crypto use cases, including buying, storing, swapping, spending, managing and trading

- User-friendly: mobile wallet apps are designed to make it easy to access your funds without much technical expertise

Which mobile wallet is best for me?

By now you might be wondering how to pick the best mobile crypto wallet for your needs. It all boils down to your preferred digital assets activities. The following are some of the leading mobile wallets across several categories.

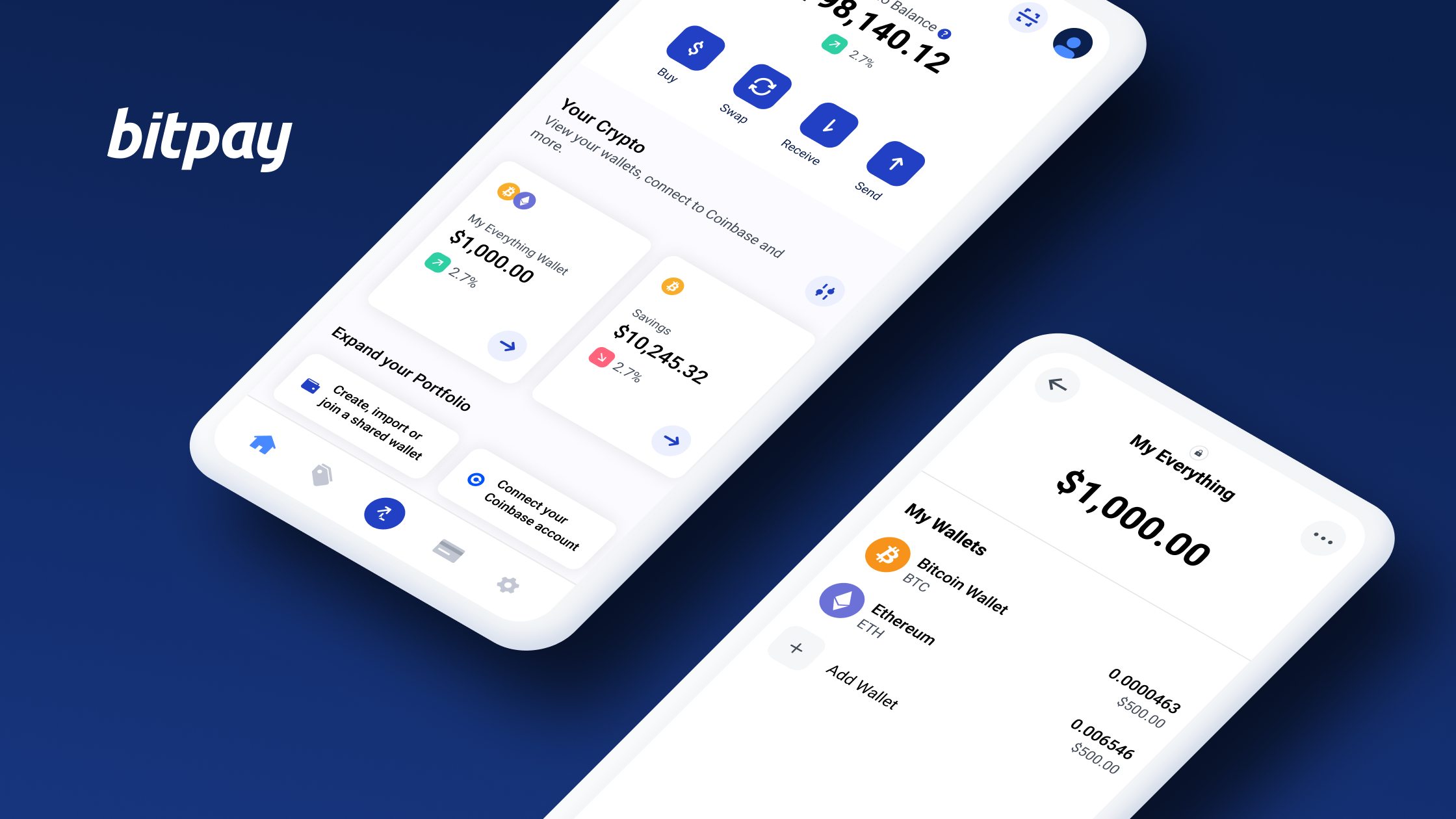

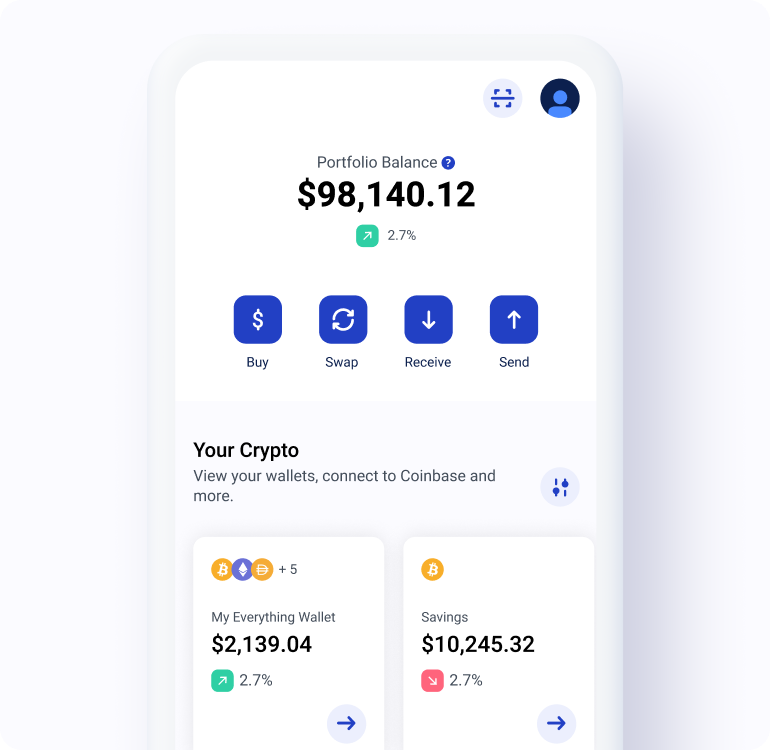

Best for self-custody: BitPay

If you’re self-custodying, the BitPay Wallet is the only mobile wallet you’ll need to secure and control your crypto assets. BitPay’s industry-leading self-custody wallet solution makes it easy to buy, swap, store, send, receive and make crypto payments, all from one easy-to-use interface. Your private keys remain in your possession at all times, so you never have to worry about trusting a third-party with securing your funds. The BitPay Wallet also offers multisignature security, giving you the ability to use either as a “joint account” with multiple copayers or a one-user multi-device system for extra security.

Take control of your crypto

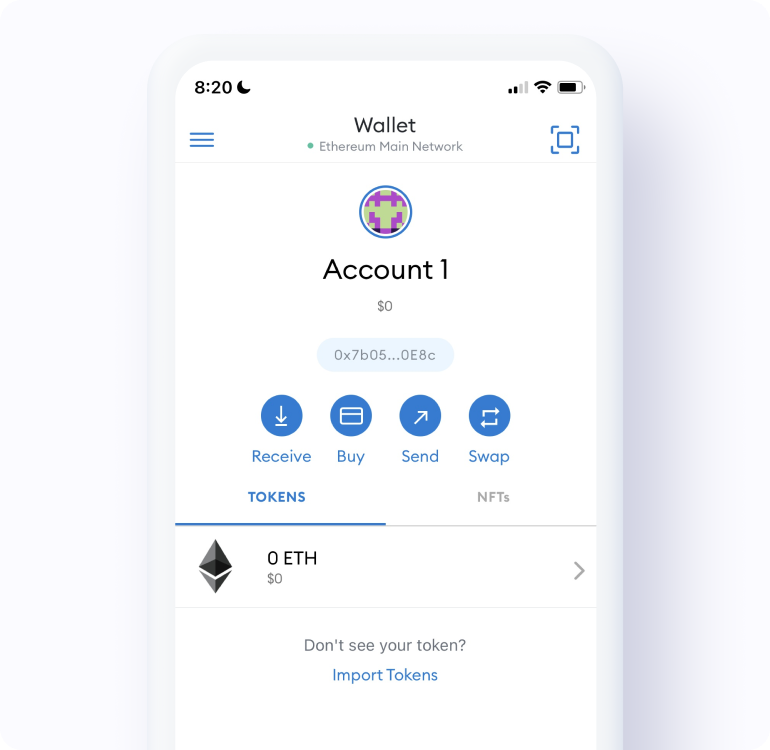

Best for Web3/DeFi and niche tokens: MetaMask

There’s a vast world being created in the crypto space, from Web3 and decentralized finance (DeFi) to niche coins and nonfungible tokens (NFTs). Accessing this ecosystem requires a Web3 wallet like MetaMask. Besides serving as a Web3 onramp, MetaMask offers a full suite of crypto wallet functionality from your mobile device or internet browser.

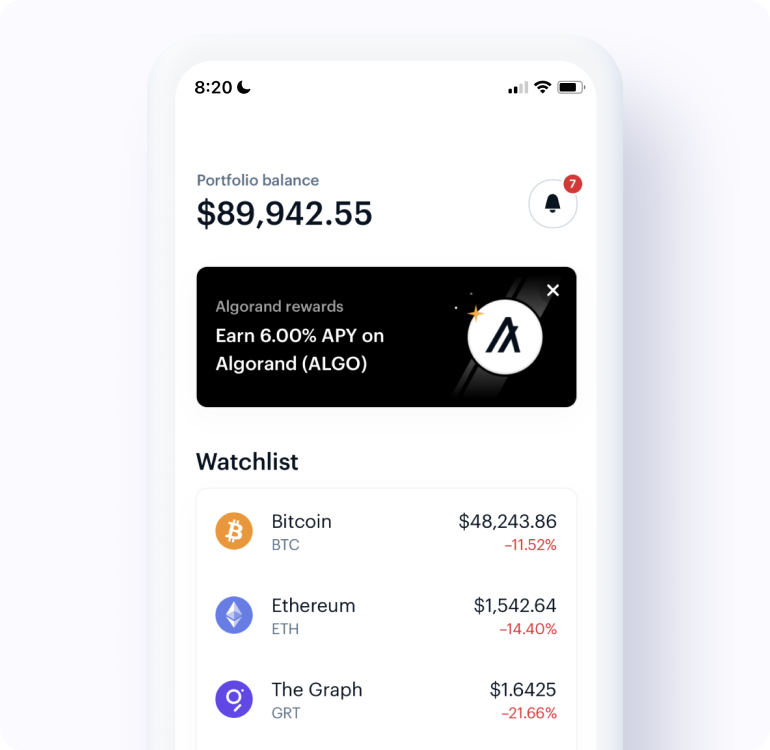

Best for custody service: Coinbase

Coinbase is the world’s largest publicly traded crypto firm, and one of the oldest and most trusted custodial crypto wallet providers. For users comfortable with a third-party holding their private keys, Coinbase is a safe platform with a solid reputation for security.

Are mobile crypto wallet safe?

The big question is this: are mobile crypto wallets safe? The answer is yes, but it largely depends on the user. If using a custody-service mobile wallet, do your homework to ensure you’re only transacting with an exchange you can trust with your funds. If self-custodying, your wallet is only as secure as you or your device are. Overall, if your encrypted password is “1234”, you didn’t bother setting up two-factor authentication, you keep your recovery phrase in your Notes app and you’re prone to losing your phone, you might be your own worst security risk. Always keep in mind that if someone is able to get your password, recovery phrase or private keys, they are free to drain your holdings.

See our crypto security tips for more on this, but the TL;DR is to never keep the bulk of your funds in one single wallet. Consider your mobile crypto wallet to be like your regular wallet and an offline crypto wallet to be like your vault.