Bitcoin will soon go through a major event called a halving, which reduces the reward Bitcoin miners receive for each new transaction block by half. It will be the fourth time in its history that BTC has undergone a halving, which occur every 210,000 blocks, or approximately every 4 years. Halvings slow the creation of new Bitcoins, keeping the supply low and preventing inflation of the currency. Ideally (though certainly not guaranteed), halvings help keep Bitcoin’s value as high as possible.

The Bitcoin halving 2024 is right around the corner, so keep reading for a crash course in what halvings mean for Bitcoin, what past halvings have done to the price of BTC and more.

When is the Bitcoin halving 2024?

The fourth Bitcoin halving is expected to happen around April 17, 2024. It’s not possible to be exact because halvings take place on a schedule not determined by dates, but by “block height.” Block height refers to a specific location in a blockchain which is measured by the number of blocks that come before it. Halvings take place at set intervals of 210,000 blocks, which historically have been reached roughly every 4 years.

After the upcoming halving (when the BTC block height reaches 840,000), the block reward paid to bitcoin miners for their work validating transaction blocks will be decreased from its current 6.25 BTC to 3.175 BTC. In the early days of Bitcoin, the block reward was 50 BTC, which dropped to 25 after the first halving, 12.5 after the second and 6.25 after the third, where it stands today.

Now let’s dive a bit deeper into the previous BTC halvings.

Past halving dates

As mentioned, Bitcoin has seen three previous halvings over its lifespan, one in 2012, another in 2016, and the most recent one in 2020. Bitcoin has changed a lot over that time, and so has the level of mainstream acceptance for cryptocurrencies as a whole. As you read over the history lesson ahead, keep in mind the important point that as in all investing, past performance is no guarantee of future results.

Halving 1: Nov. 28, 2012

BTC Price at time of halving: $12.20

Highest price reached during cycle: $1,170 (Nov. 2013)

The first Bitcoin halving was something of a tense time for crypto investors and fans, with fears the reduced incentive would discourage miners from keeping the network running smoothly. It also came just as Bitcoin was finally starting to get some mainstream attention.The inaugural BTC halving happened at block 210,000 and saw the block reward drop from 50 BTC to 25 BTC.

Halving 2: July 9, 2016

BTC price at time of halving: $640

Highest price reached during cycle: $19,650 (Dec. 2017)

Bitcoin’s second halving was on July 9, 2016, significantly higher than at the time of the first halving but still a far cry from the prices in the years that followed. Coming off Bitcoin’s performance after the first halving, traders expected another bull run. Bitcoin did indeed experience a massive bull run in 2017, but by the end of 2018 it was in a price trough again, slipping to around $3,700 by New Year’s Day 2019. Halving #2 reduced the block reward from 25 BTC to 12.5 BTC.

Halving 3: May 11, 2020

BTC price at time of halving: $8,600

Highest price reached during cycle: $67,500 (Nov. 2021)

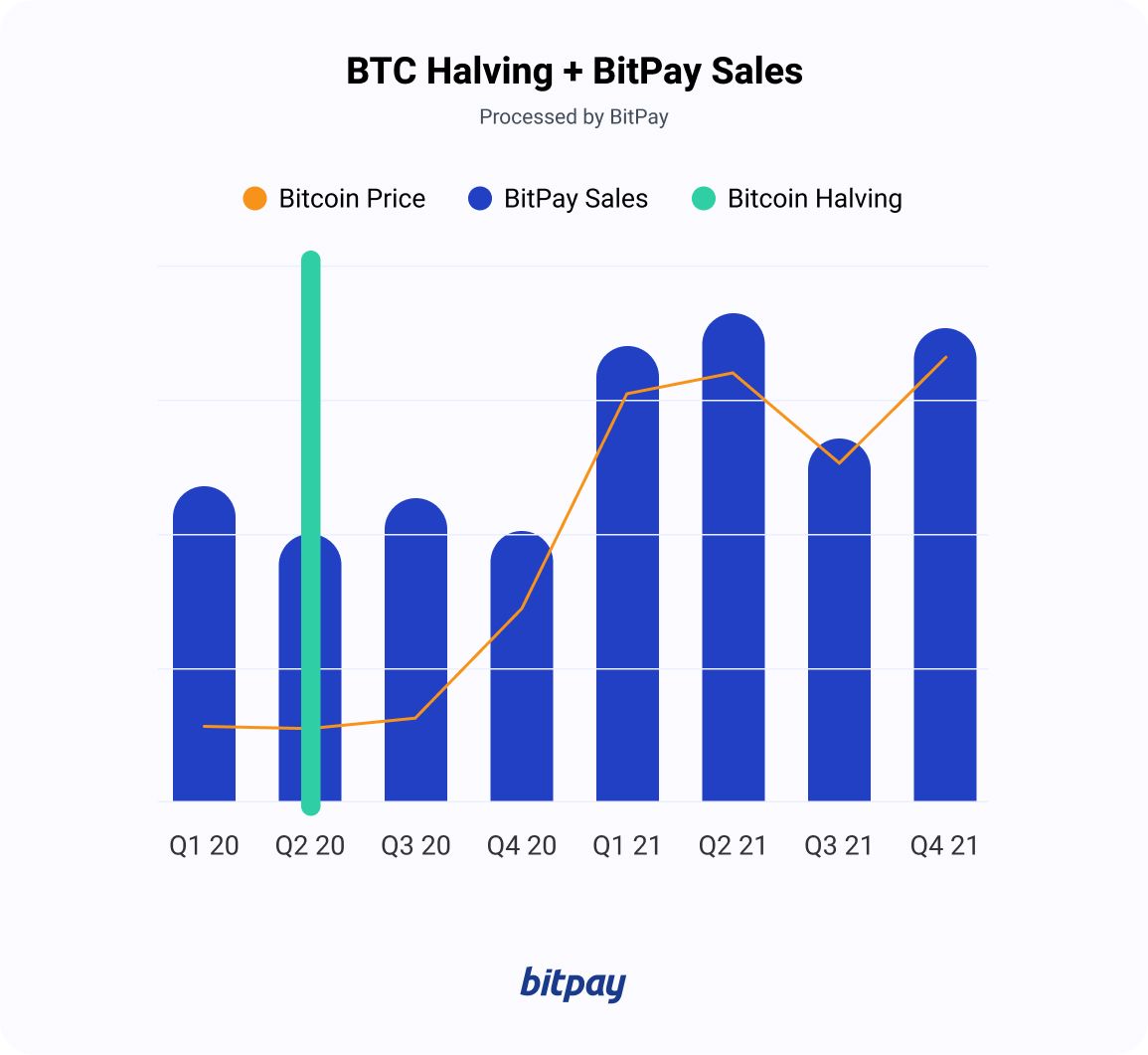

The most recent BTC halving took place at the height of pandemic-era lockdowns. By this time, crypto was closing in on mainstream acceptance as institutions began exploring adoption and crypto payments had become commonplace. Bitcoin had its biggest bull run to date in 2021, with prices flirting with $68,000 before crashing by the end of the year and throughout most of 2022. The third Bitcoin halving, taking place at block 630,000, saw block rewards once again slashed by half to 6.25 BTC, where they will remain until the 4th halving in mid-April.

Does the Bitcoin price increase or decrease after halvings?

The cheeky answer to this is simply “yes.” But that’s actually the truth. Although each halving to date has been followed by a major bull run, a significant pullback came shortly afterwards every single time. Additionally, each of those post-bull run crashes were followed by widespread market slowdowns ranging from a mild chill to a full-blown “crypto winter.”

A final word on buying Bitcoin before the next halving

Many crypto watchers are expecting another bull run after next year’s halving, though the aftereffects are never set in stone. Plus, now that it’s anticipated, any possible post-halving bull run might already have been priced into the market. As always, don’t try to time the market, don’t invest with funds you can’t afford to lose and be prepared for potential market changes. The most successful, time-tested investment strategy includes consistent investing via dollar-cost averaging (DCA).