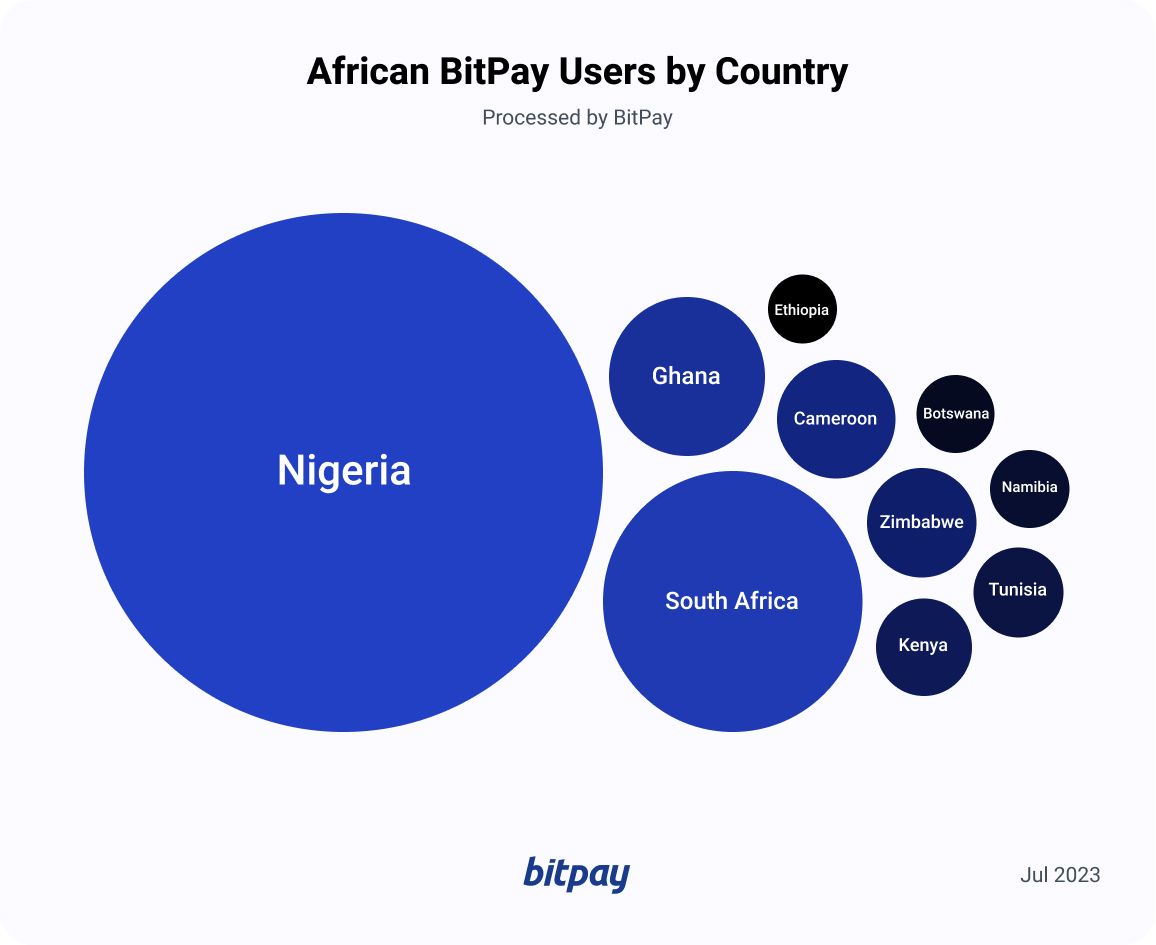

Africa’s cryptocurrency adoption is silently on the rise. Tech-savvy Ghanans, Nigerians, and South Africans are leading the crypto movement, adopting Bitcoin, stablecoins, and other cryptocurrencies to instead of traditional banking services. Cryptocurrencies are helping African communities by giving them access to financial options they didn't have before. This levels the economic playing field and helps customers in underserved markets succeed.

What’s spurring crypto’s surge in Africa?

For some Africans, cryptocurrency is seen as a vital tool to preserve and build wealth. Blockchain is helping African diasporas send money to families cheaply and securely. Crypto is increasingly seen in shops and markets. With countries like Nigeria becoming hotbeds for crypto adoption, it's no wonder we're seeing more African businesses adopting crypto payments. But why Africa?

Crypto payments are faster and cheaper than traditional international money transfers, which means Africans can keep more of their money instead of paying large currency exchange rates, transfer rates, or other fees. With cryptocurrencies like BTC, there is no need for third-party intermediaries; you can send money directly from one person or company to another without paying extravagant fees or waiting days on end for transactions to clear through traditional financial institutions.

This is a huge boon to small businesses and startups looking to grow their customer base without needing more resources or access to traditional banking systems. Peer-to-peer exchanges keep more money in African pockets.

This makes crypto ideal when speed and cost savings matter most. Still, it also has applications outside those realms. Businesses can use crypto as an alternative payment method when traveling abroad or sending funds abroad via remittance services like Western Union or MoneyGram.

Despite top coins like BTC and ETH being subject to volatility, Africans continue to adopt crypto as inflation fluctuates. These coins have a relatively fixed supply and stable activity, making Bitcoin’s inflation rate of 1.7% seem tame compared to the average 14.47% inflation rate seen in Sub-Saharan Africa through 2022. And with the continued popularity of stabelcoins like USDC and USDT, crypto can be seen as a more stable means of payment.

And while Africans themselves are embracing crypto, governments are split, with some adopting the technology and others imposing restrictions.

Several African nations have introduced government-regulated digital currencies, called central bank digital currencies, or CBDC. They help ensure safety and efficiency in financial transactions. CBDCs also promote compatibility and smooth transactions. Alternatively, almost 20% of sub-Saharan African countries have banned crypto assets.

Crypto usage in Africa by the numbers

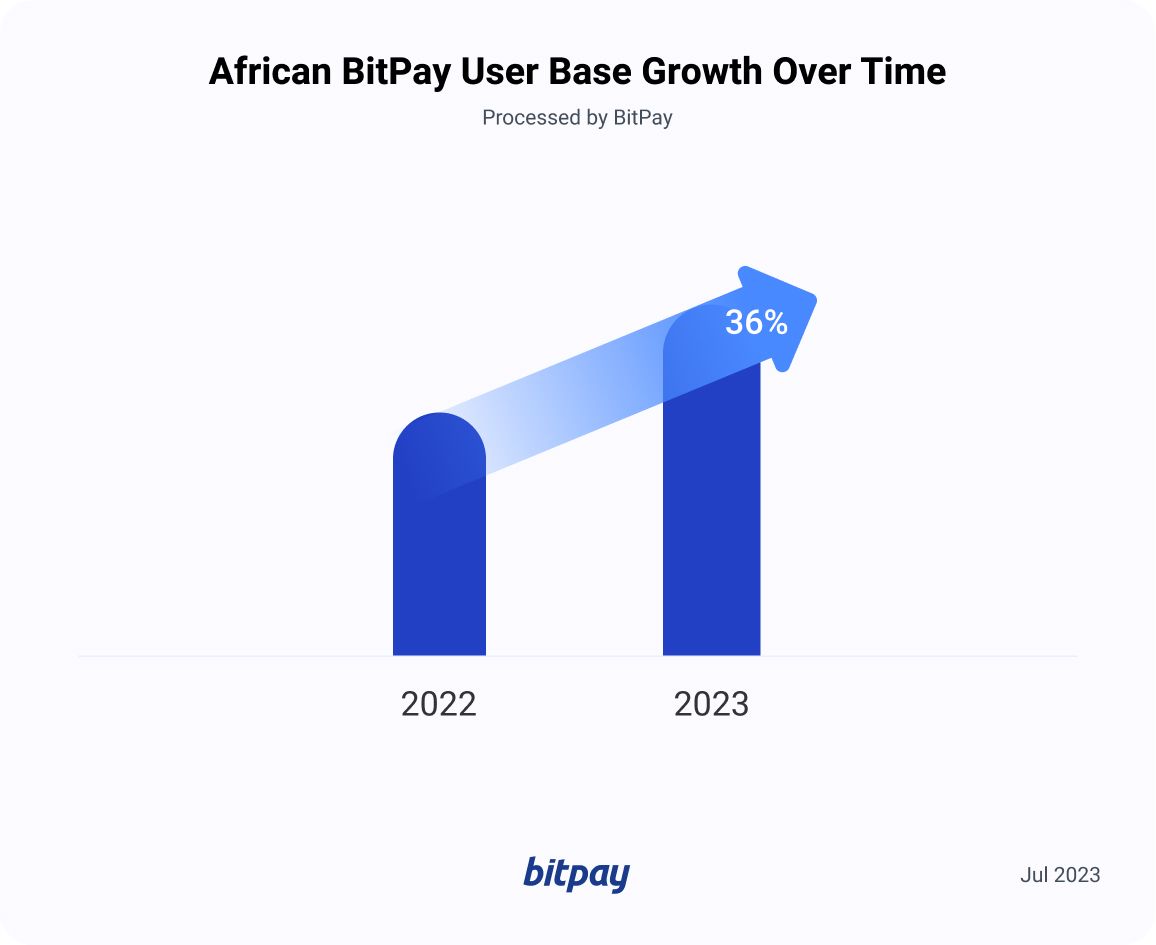

The number of BitPay users across African countries grew 36% from 2022 to 2023.

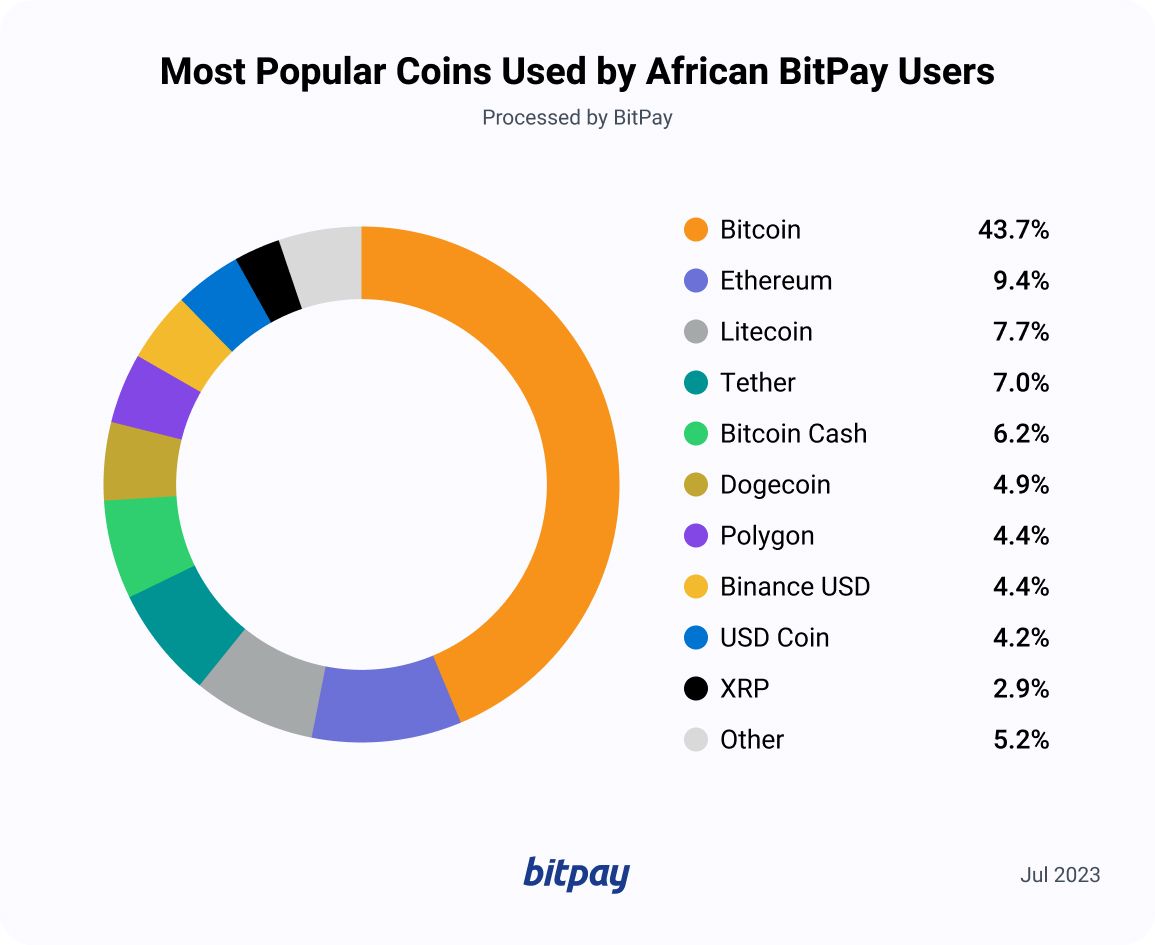

Bitcoin is the most popular coin used, with Ethereum, Litecoin, Tether and Bitcoin Cash gaining ground.

Nigeria, South Africa and Ghana are among the top countries wehre cryptocurrency transactions occur.

What’s next?

The adoption of cryptocurrencies in Africa is on the rise, driven by young Africans seeking alternative financing options. This trend opens up previously unavailable financial opportunities, leveling the economic playing field, and empowers underserved markets.

As Africans continue their embrace of blockchain payments, BitPay will support the crypto community with its payment solutions for businesses and individuals. The evolving crypto landscape in Africa presents both opportunities and challenges, but it is clear that cryptocurrencies are reshaping the financial landscape and empowering individuals and businesses across the continent.